Where Is the Economy Now?

As we enter the fourth quarter of 2025, it’s appropriate to take stock of where the national economy is today and where it is expected to go in the fourth quarter. Here is what our team of economists at Nationwide are expecting.

Current State: Softening but Still Expanding

With the labor market rapidly losing steam and tariff impacts on inflation moderate, the Federal Reserve has restarted the process of cutting interest rates. It’s our assessment that lower interest rates should help to shore up activity through the end of 2025 until fiscal stimulus and tax incentives arrive in 2026. While economic activity is still expected to dip in the fourth quarter, recession odds look low as peak uncertainty surrounding the tariffs and its impact are behind us.

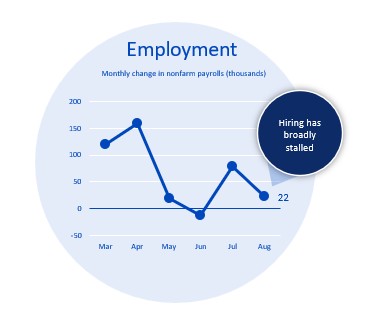

Employment: Approaching Stall Speed

Job growth stalled in August and continued to be contractionary outside of education and healthcare. Nonfarm payrolls increased by just 22,000 in August, marking a fourth straight month of subpar gains and bringing the three-month average for job gains to only 29,000.

The pace of hiring is even weaker when looking beneath the surface. After removing private education and health care services from the data, employment has contracted by a combined 87,000 over the last four months. Additionally, news from the U.S. Bureau of Labor Statistics (BLS) earlier this month showed even greater stress. BLS released preliminary benchmark revisions of employment over the last year that amounted to a large downward revision of 911,000 jobs from April 2024 to March 2025, which reduces the number of estimated jobs created by roughly half. As such, just 70,000 jobs per month on average were created in that period versus the prior estimate of 146,000.

Inflation: Continues to Creep Up

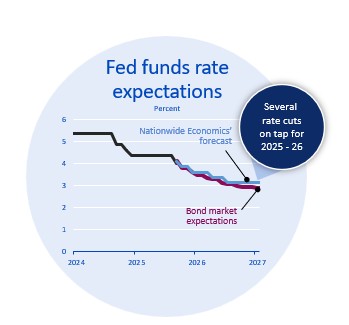

Headline Consumer Price Index inflation climbed to 2.9% in August, while the core rate held steady at 3.1%. There was also a greater degree of tariff pass-through in August, particularly for non-discretionary items like food at home which helped to lift the headline higher than the core rate. The mildly hotter-than-expected inflation data will do little to dissuade the Fed from engineering a series of rate cuts considering the weakening in the labor market. We see the Fed cutting the fed funds rate by 75 bps by year end.

The Fed: Policy Easing in Q4 and 2026

As widely anticipated, the Fed restarted its rate cuts this month with a 25 basis points (bps) reduction as insurance against a weakening labor market. Chairman Jerome Powell’s latest public comments have struck a notably more dovish tone as Fed officials assesses the downside risks to employment are rising materially.

Looking ahead, we expect another 50bps of rate cuts by year end, bringing the total reduction over 2025 to 75bps. Additionally, we anticipate 50bps of cuts in 2026 as policymakers focus on supporting the job market while looking past a modest, and what we expect will be a temporary, rise in inflation. With the labor market now on a much weaker footing, the odds that the FOMC announces a larger 50bps cut at one of the remaining 2025 meetings in October or December are climbing.

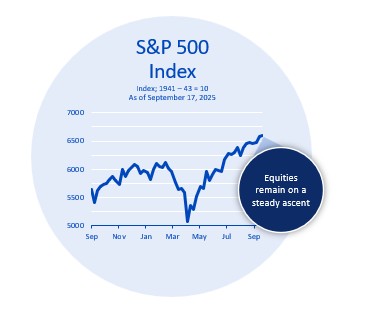

Markets: Expect Buoyancy

Stock investors are holding onto relatively ebullient attitudes after a reassuring Q2 earnings season and expectations for a series of Fed rate cuts. Earnings rose a strong 12% year-over-year last quarter.

Risky assets are adding to their gains, with equities rising and corporate credit spreads remaining very tight as positive Q2 earnings and continued economic resilience lift investors’ spirits. We expect positive fundamentals and looser Fed policy will support equity values and lead to a steeper Treasury yield curve.

To find more information about the state of the economy, listen to Economic Insights By Nationwide, wherever you listen to podcasts.

Find one-of-a-kind resources and tools to help your business succeed in Greater Des Moines (DSM). Network with professionals at local events, learn about Partnership initiatives and find new ways to attract top talent to the region.

Kathy Bostjancic

Kathy Bostjancic is the Senior Vice President and Chief Economist for Nationwide Mutual. Kathy leads a team of economic analysts delivering economic forecasts and analyses that are used to inform and strengthen the organization’s business strategies and operating plans.