What's Trending: Employer-Sponsored Student Loan Repayment

Student Loan Repayment Assistance

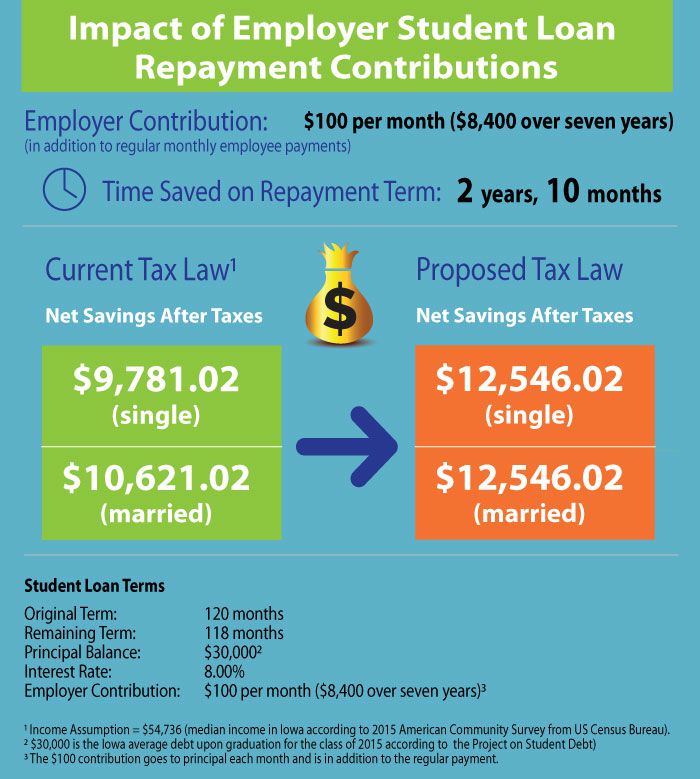

More and more companies are exploring expanded benefit programs including repayment assistance for their employees' student loans with some existing plans ranging from $1,000 to $10,000 maximums per employee. The benefits of these plans are two-fold: Employers have a tool to attract and retain needed talent, and new hires get help managing their student debt.

While this seems like a win-win, there is one missing piece — employer-sponsored student loan repayment isn't tax-free in the way that tuition reimbursement and many other benefits are. Currently, these student loan payments are counted as income and are subject to income tax.

Proposed Legislation

As interest from both employers and employees grows, on both the national and local levels, so too does the support for changing current tax law. Proposed federal legislation, H.R. 795 and S. 796, would amend the Internal Revenue Code of 1986 to extend the exclusion for employer-provided educational assistance to employer payments of qualified education loans, known as the Employer Participation in Student Loan Assistance Act.

The legislation engages private employers and encourages them to offer a tax-free benefit to put toward an employee's student loan debt. This would allow for a tax-exempt benefit of up to $5,250 per year, the same rate allowed for tuition assistance, to pay on already incurred student loan debt.

It's important to note that these employer-made payments would be above and beyond the employee's monthly minimum payment, for which they'd still be responsible, helping the employee repay their loans faster and reducing interest costs. Employees utilizing these plans are more quickly able to participate in retirement savings, home buying or meet other obligations. A goal of the Greater Des Moines Partnership is to create an environment where this is possible for more and more employees.

The illustration below shows the potential benefits of employer contributions toward student loan repayment under the current and proposed tax law:

By collaborating with elected officials on legislation directly affecting residents within the region, The Partnership can focus on issues that matter to those living here and those looking seriously at relocating to Greater Des Moines (DSM). Learn more about The Partnership's talent development resources, including ways to find talent, relocation information, an Internships 101 Guide, Seize the City internship program and more.