Consider the Benefits and Challenges of a 1099 Career Choice

“When are you going to get a real job?” asked the concerned family member. It was the fifth time this question was asked in the last few months, much to the surprise of the recipient. Considering they were making a good income, working hard and using their skills to do work they care about, this question was always a head-scratcher.

Welcome to the world of the 1099 economy!

What is the 1099 economy? The 1099 economy, sometimes referred to as the gig economy, is an alternative structure of employment to the traditional W-2 employee. A W-2, which is a reference to a particular form an employer uses to communicate income to the IRS, is an employee in the traditional sense of having a job, getting a steady paycheck and knowing that the job will be waiting for them next week. It’s the quintessential “get a job” sort of job. A 1099 worker (also in reference to a particular IRS form), on the other hand, isn’t an employee of the company. Their employment status is a third-party contractor or consultant. They don’t get a normal paycheck and there’s far less certainty that future work will be waiting for them once the short-term nature of their work is complete.

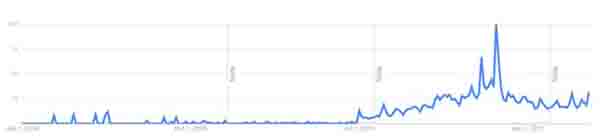

The term “gig economy” has catapulted into our vocabulary in recent years. As you can see from the Google Trends image below, the term exited obscurity and moved mainstream in mid-2015. It was increasingly relevant in the years to follow, with the onset of COVID-19 pushing it into the stratosphere.

Despite rising in prominence and into the broader culture, the 1099 economy is still largely demeaned, disrespected and dismissed. After all, it’s not a “real job.” I think this perspective is as short-sighted as it is misunderstood.

There are a few key differences between W-2 and 1099, which primarily revolve around income taxes. As Americans, when we earn income, we have the responsibility of paying 15.3% to the federal government in the form of payroll taxes (which includes 12.4% for Social Security and 2.9% for Medicare). This is in addition to federal and state income taxes. When we’re a W-2 employee, we pay half of these payroll taxes, and our employer pays for the other half. As a 1099 contractor, we’re responsible for the entire share ourselves. In other words, a 1099 contractor is personally responsible for an additional 7.65% of income taxes compared to their W-2 counterpart. There’s also a big difference in how income taxes are withheld. Note, both types of workers pay federal and state income taxes based on their respective tax brackets. As a W-2 employee, our employer automatically withholds all taxes (federal, state and payroll) and submits them to the appropriate governing bodies on our behalf. When it’s time to file taxes each spring, most or all our tax liability has already been paid. 1099 contractors, on the other hand, are fully responsible for administering their own tax withholding. When a check is received, it’s a true gross number. The onus is on us, as a 1099 contractor, to do our own withholding when we get compensated.

From a purely mechanical standpoint, that’s the only difference between a W-2 employee and a 1099 contractor. It’s also where all the other differences (or perceived differences) begin.

H2 – Perceived Risk

One of the biggest criticisms against the 1099 economy is the perceived risk of this type of work. After all, 1099 contractors aren’t actual employees of a company. Translation: they can be given the boot at any time for any reason. This inherently feels risky. While there is some truth in this narrative, I think it only captures half of the truth. One of the perks of being a 1099 contractor is the ability to serve multiple clients. Most 1099 contractors I know serve anywhere from 3-10 different clients. While it’s true none of these engagements have real certainty, this structure offers a diversification of income streams. If a 1099 contractor gets “fired” from one engagement, they don’t lose 100% of their income. In my book, this is less risky.

Is it Enough?

Another criticism of the 1099 economy is that it’s perceived as a series of part-time jobs. In our minds, “part-time” is correlated with low pay. While this can certainly be true, it can also be the opposite. Some of the most financially successful people I know are 1099 contractors. One’s income isn’t defined by their employment status, but rather their ability to find clients who value the contractor’s work and are willing to pay for it. One of my clients is an example of this dynamic. They recently left their $75,000/year W-2 job and now have six clients who each pay roughly $20,000 per year. That was a huge increase, especially considering they no longer have a “real job” (tongue in cheek). This is where the irony between meaning and money comes to light. By pursuing meaning (i.e., digging into work that matters for clients you wish to serve), you often find the money. It can be a tremendously fulfilling endeavor.

It Can Be Stressful

Some perceive the idea of having to constantly find and cultivate new clients as quite stressful. They would be correct! With traditional W-2 employment, the work is right there in front of you. As a contractor, the responsibility falls on your shoulders, and your shoulders only, to cultivate new opportunities. There’s no doubt this brings additional stress and pressure. However, this role is oftentimes embraced and welcomed by those in the 1099 economy. With great responsibility comes great opportunity.

After dwelling on the perceived negatives of the 1099 economy, are there any true positives? I’m glad you asked! As a matter of fact, there are!

Work That Matters

One of the main attractions of 1099 contract work is the ability to curate your work and control the types of projects you find value in. It’s more than a simple economic engagement. Factors such as values, lifestyle rhythm, passions, core beliefs and relationships all come into play. There are countless reasons why one would say “yes” (or “no”) to a potential engagement. If you wake up one day doing work you hate for people you don’t care to associate with, that’s on you. I find this to be an exhilarating feature of 1099 work. It acts as a blank canvas, waiting for us to create something beautiful and fulfilling.

Alignment of Interests

We won’t always make the right choices in our 1099 engagements, but at the same time, we also have enough control to make a shift (if we have the courage to do so). It also keeps all parties honest by bringing transparency to both the independent contractor and the business. My entire team is composed of 1099 contractors. If I’m not good to work with and/or don’t treat them well, they will fire me as a client without even blinking an eye. On the other hand, if they don’t serve me well, they may lose the right to serve me in the future. There’s a purity in this construct that I wholeheartedly welcome. It turns into a spider web of people using their gifts and passions to serve other people, and vice versa.

Let’s Talk IRS … Again

In addition to the tax considerations mentioned above, we’re not done talking about taxes. 1099 contractors receive many other tax benefits in the form of deductible expenses. I always advise people to discuss this with their trusted tax professional, but common deductions include:

-

home internet

- cell phone

- mileage

- equipment purchases (such as laptops or phones)

- health insurance premiums

- home office

- travel expenses

- subscriptions

- continuing education

These benefits add up quickly and can be a real blessing to people engaging in the 1099 economy.

I’m a big advocate for the 1099 economy. With that said, I don’t think one is better than the other, as both can provide a fruitful and meaningful career. My encouragement is for us to simply find work that matters, whether that’s a traditional W-2 job or in the 1099 economy. Will you join me in reversing the negative stigma? Let’s bend the cultural narrative and create an environment where both approaches are worthy of honest consideration, by both professionals and organizations.

*To hear more about this topic, we recently published a Meaning Over Money podcast episode titled, “225 - Demystifying the 1099 Economy: The Future of Work is Upon Us.” You can find it on Apple, Spotify or wherever you listen to podcasts.

Looking for tools to help grow your startup or small business? Visit the Small Business Resources Hub to find the information you need.