From Insight to Investment: How the Partnership’s Research Team Can Support Smarter Growth

Article and maps prepared by Brett Lucas, Director of Research, Greater Des Moines Partnership

Economic growth doesn’t always come from discovering the next untapped market. More often, it comes from seeing existing markets differently.

As communities grow and mature, expansion decisions become more complex. Prime locations are harder to find, competition is denser and the cost of getting it wrong increases. For investors, the question shifts from “where can we grow” to “how can we grow” with confidence.

This type of challenge illustrates how advanced data tools can support smarter growth decisions for retailers operating in competitive markets.

Supporting Investor Growth Beyond the Metro

Many Midwest-based retailers face a similar challenge: identifying growth opportunities in markets that are already dense with competition and established consumer patterns.

Consider a fast-growing regional hub in the Upper Midwest, anchored by a major healthcare employer and supported by strong commuter flows and steady population growth. While the market may appear saturated at first glance, deeper analysis can often reveal more nuanced patterns of opportunity.

Rather than relying on assumptions, a retailer could work with an economic development organization’s research team to take a deeper, data-driven look.

A mature retail landscape makes this type of market ideal for testing data-driven site selection.

The Partnership’s Role: Turning Data into Confidence

At the core of this type of engagement is a simple goal: help an investor make better-informed decisions by translating complex data into clear, actionable insight.

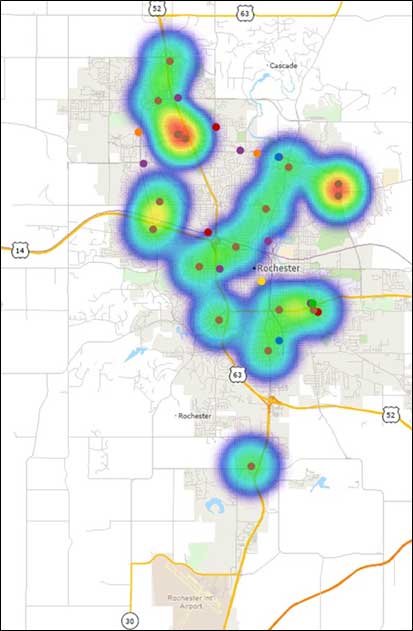

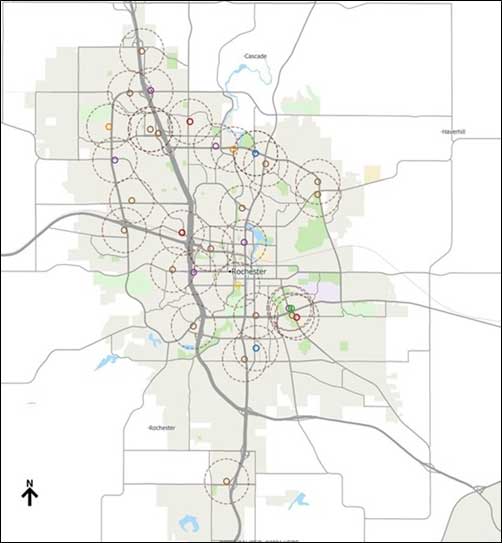

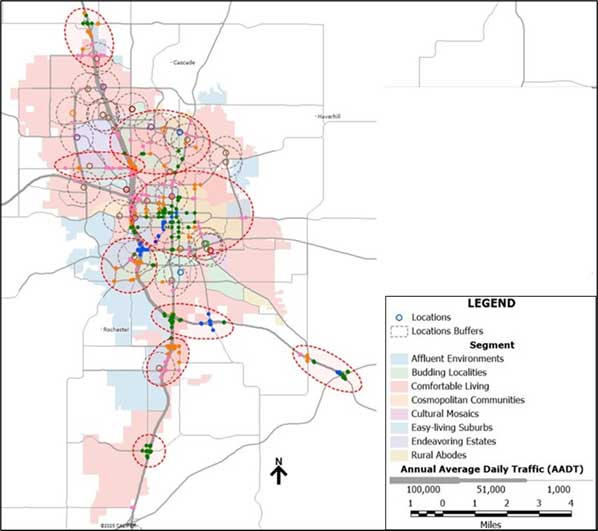

The Partnership’s research team applied a combination of geospatial analysis (GIS) and predictive modeling to evaluate this type of market from multiple angles. Instead of focusing on individual parcels in isolation, the team looked holistically at how people live, work and move through the city.

This approach layered traffic and commuter patterns, population and household growth trends, income and consumer spending behavior and competitive spacing and market coverage. This type of analysis reflects a growing role for economic development organizations, not just as conveners, but as strategic partners equipped with advanced research capabilities.

Traffic and commuter pattern analysis can reveal how people actually move through a market, not just where stores already exist.

Seeing Opportunity Where It Wasn’t Obvious

In scenarios like this, advanced analysis can challenge initial perceptions of saturation.

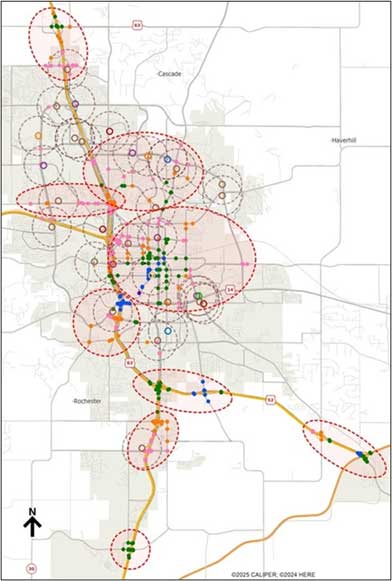

While some areas were indeed well served, this type of analysis can reveal underpenetrated corridors and emerging clusters, places where traffic volumes, growth patterns and consumer demand aligned, but retail coverage had not yet caught up.

Importantly, these opportunities did not appear as isolated points on a map. They formed logical groupings that could support a phased expansion strategy, while reducing risk and maximizing long-term return.

From Insight to Action: Smarter, Phased Growth

Rather than pursuing expansion all at once, this type of analysis can help inform a staged rollout strategy: prioritizing the highest-confidence locations first, testing performance before committing additional capital and adjusting site plans as real-world conditions evolved.

Advanced analytics can be used to explore potential outcomes, such as expected sales ranges or cannibalization risk, as part of a broader decision-making process. Just as importantly, the tools were used to support, not replace, real estate judgment and local market knowledge.

This type of analysis can reveal opportunity clusters that support phased, lower-risk expansion.

Why This Matters for Economic Development

This type of engagement demonstrates how economic development organizations can support investors.

Today’s growth decisions demand more than anecdotal insight or static market reports. Investors are looking for partners who can reduce uncertainty, accelerate decision-making, and align capital investment with long-term community growth.

By leveraging advanced research capabilities, the Greater Des Moines Partnership helps investors navigate complexity and identify opportunities, even in mature, competitive environments.

Clusters paired with lifestyle segmentation.

A Model That Scales

While this case focused on a single market, the approach is broadly applicable. GIS and AI enabled analysis can be adapted across industries and geographies, offering a repeatable framework for smarter expansion, stronger partnerships and more resilient regional economies.

For The Partnership, this work reinforces a simple principle: when investors are equipped with better insight, communities are better positioned for sustainable growth.

Learn more about The Partnership’s economic development services and how to work with our experts.

Disclaimer: This article presents a hypothetical scenario for illustrative purposes only and does not describe an executed project or specific investment decisions.

Keep up with the momentum that's happening in and around Greater Des Moines (DSM) when you subscribe to one or all of the Greater Des Moines Partnership's newsletters — they're packed with the latest news, highlighting everything from upcoming events to development projects to policy updates. Join the mailing list to connect with The Partnership and help amplify stories from around the region.